The performance and risk assessment of the unique identifiers 372229933, 702071224, 605693639, 662900961, 983460133, and 934452768 presents a multifaceted view of their financial viability. By scrutinizing performance metrics against benchmarks, one can systematically identify strengths and vulnerabilities. Additionally, understanding the risk factors tied to these identifiers reveals how external market conditions may influence asset volatility. A closer examination of these elements may uncover strategic avenues for investment optimization.

Understanding Performance Metrics of Unique Identifiers

When organizations implement unique identifiers, understanding their performance metrics becomes crucial for optimizing operational efficiency.

Performance benchmarks play a significant role in evaluating success, allowing for effective identifier comparison. By analyzing these metrics, organizations can identify strengths and weaknesses, ensuring that unique identifiers align with strategic goals.

This analytical approach empowers organizations to enhance their operational frameworks and ultimately achieve greater autonomy in decision-making.

Assessing Risk Factors Associated With Investment Identifiers

While unique investment identifiers serve as essential tools for tracking and managing financial assets, the associated risk factors must be rigorously assessed to ensure informed decision-making.

Risk evaluation is crucial, as investment volatility can significantly impact asset performance. By understanding these risk factors, investors can make strategic choices that align with their risk tolerance and investment objectives, promoting a more resilient financial portfolio.

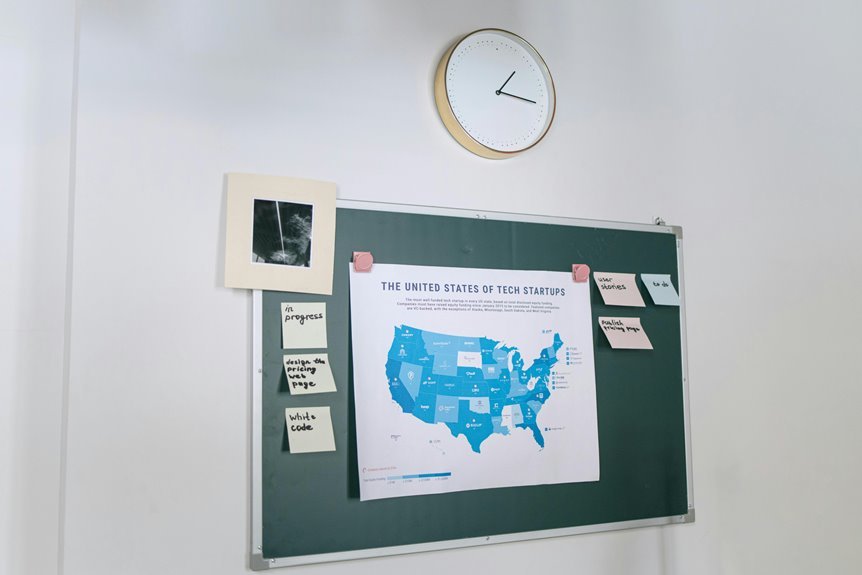

Analyzing Market Trends Through Identifier Data

Investment identifiers not only facilitate tracking but also provide a foundation for analyzing market trends.

By examining identifier correlation, analysts can discern patterns that reveal underlying market dynamics.

Trend analysis utilizing these identifiers enables investors to recognize shifts in demand, supply, and sentiment, empowering informed decision-making.

This objective approach ensures that stakeholders remain attuned to evolving market landscapes, ultimately fostering investment freedom.

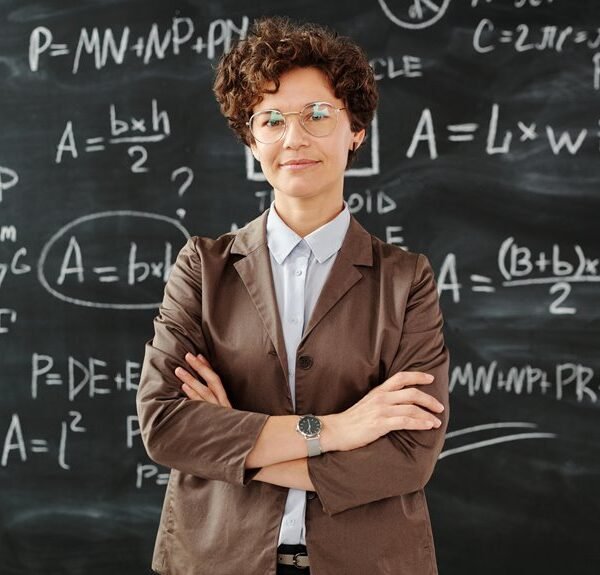

Developing an Informed Investment Strategy Based on Performance and Risk

Developing a robust investment strategy necessitates a thorough understanding of both performance metrics and associated risks.

Effective investment diversification plays a crucial role in mitigating potential losses while maximizing returns. By employing portfolio optimization techniques, investors can strategically allocate assets, balancing high-performing securities with riskier options.

This informed approach enables individuals to navigate market fluctuations while pursuing financial independence and long-term growth.

Conclusion

In the grand theater of finance, the unique identifiers—372229933, 702071224, 605693639, 662900961, 983460133, and 934452768—perform their scripted roles, dancing between risk and reward. Yet, as investors clamor for the spotlight, one must ponder: are these figures merely puppets in a market marionette show, or do they hold the key to a well-orchestrated financial symphony? Ultimately, the true art lies not in the identifiers themselves, but in discerning the subtle strings that govern their fate.