The financial performance overview of identifiers 2115000005, 954441111, 943205753, 666105800, 628232770, and 612402564 reveals a complex interplay of growth and risk factors. Each identifier displays unique characteristics that influence their market positioning and operational effectiveness. Notably, while some exhibit strong growth trends, others struggle with stability. This variance prompts a closer examination of the underlying factors driving these outcomes and the implications for future strategies.

Performance Analysis of Identifier 2115000005

The performance analysis of Identifier 2115000005 reveals key insights into its financial metrics and operational efficiency.

The revenue breakdown indicates diverse income streams, affirming a robust market positioning.

An examination of its competitive stance highlights strengths and weaknesses, essential for strategic planning.

This analytical overview provides stakeholders with the necessary data to understand the entity’s performance within its operational landscape, fostering informed decision-making.

Growth Trends for Identifier 954441111

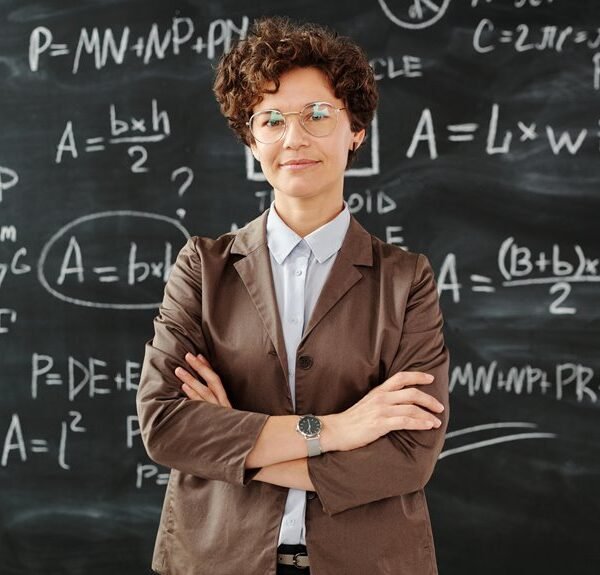

Growth trends for Identifier 954441111 illustrate a compelling trajectory within its market segment.

The organization has demonstrated significant market expansion, capitalizing on emerging opportunities. Revenue projections indicate a sustained upward momentum, driven by innovative strategies and consumer demand.

This analysis underscores the potential for continued growth, positioning Identifier 954441111 favorably against competitors and reinforcing its relevance in an evolving marketplace.

Financial Insights for Identifier 943205753

Financial insights for Identifier 943205753 reveal a nuanced picture of its economic performance within the industry.

Evaluating its investment strategies indicates a responsive approach to market fluctuations, demonstrating adaptability amid changing conditions.

This identifier’s prudent financial management highlights its resilience, presenting opportunities for stakeholders seeking to optimize returns while navigating the complexities of the current economic landscape.

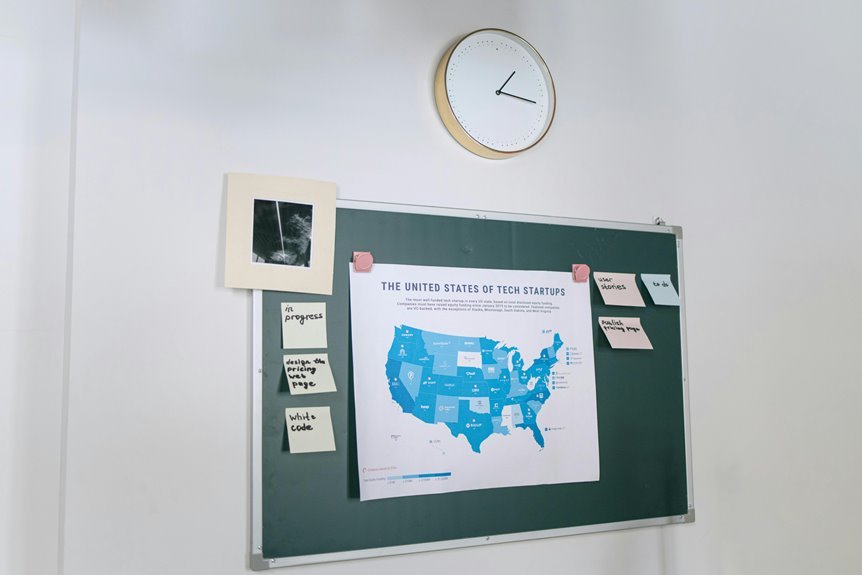

Comparative Overview of Identifiers 666105800, 628232770, and 612402564

A comparative analysis of identifiers 666105800, 628232770, and 612402564 reveals distinct patterns in their financial trajectories and operational strategies.

Performance metrics indicate that identifier 666105800 demonstrates superior growth potential, while 628232770 exhibits steady stability.

Conversely, 612402564 faces heightened risk assessment challenges, impacting its overall performance.

These insights inform strategic decisions, emphasizing the importance of tailored approaches to financial management.

Conclusion

In summary, the financial performance of the identified entities presents a tapestry of opportunities and challenges. While some, like 2115000005 and 954441111, bask in the glow of growth and expansion, others, such as 612402564, navigate a more intricate landscape of risks. The variations in performance underscore the importance of tailored strategies to harness strengths and mitigate weaknesses, ultimately guiding stakeholders toward informed decision-making in a dynamic market environment.